I’m not a cryptocurrency expert. If I were to rate my knowledge of crypto from 0 to 100, I’d give it about a 3. But since most people are at about 0.2, that means I’m 15 times smarter than you about the topic and, even though I barely understand how the shit works, I’m justified in giving advice.

It’s not what you know, but how much you can pretend to know when talking to people who know even less than you. That’s how sales work nowadays, right?

The purpose of this post isn’t to act like I’m a crypto savant—I am straight up telling you I’m a donkey on the subject—nor is it to give you a bunch of basic instructions on how to buy Bitcoin, Ethereum, or anything else. You can find both know-it-alls and generic how-to guides all over the internet.

Instead, I thought it would be cool to share a few things I’ve learned thus far in my dive into cryptocurrency—most of which are more trading/market-centric than specific to crypto—and maybe clear up a few misconceptions.

Learn to buy and properly store major coins before trading.

If you listen to The Three Donkeys podcast, you hear Peter Jennings, Adam Levitan, and I tell stories about trading ridiculous cryptocurrencies like Titcoin, or the time I owned a huge percentage of Vegas’s strip club currency (not to brag).

And so my initial piece of advice here might surprise you: don’t get into crypto so you can buy up coins whose primary purpose is to make it easier to get a lap dance. “Now wait, I’m supposed to swipe this where?!”

This post isn’t meant to walk you through how to buy and store crypto or go into depth about the various exchanges and wallets because there’s a mountain of content out there already, but I’ll give you a few reputable sites/tools to help you out. There’s a lot of good stuff out there, so this is just a shortlist to get you started…

Coinbase

- Simple to use

- Beginner-friendly place to start buying BTC, ETH, BCH, or LTC

Kucoin.com

- Ability to trade cryptocurrency

- Beginner-friendly

- Lots of bonuses and giveaways

Changelly

- Must already own cryptocurrency to use

- Allows trading of currency pairs you cannot trade elsewhere

- Easy-to-use exchange that searches for best rates at other sites for you

Trezor

- High-security hard wallet on which you can and should store coins you plan to hold

- Safer than keeping coins on an exchange

There are a variety of other sites and exchanges out there, but there’s really no reason to be trading Einsteinium on an advanced exchange until you learn how to purchase currencies and store them on a hard wallet.

I’d start by learning how to purchase Bitcoin on CEX.IO or a comparable site and send anything you don’t plan to trade to a Trezor or another hard wallet (Ledger is another good one).

A couple tips: use a bank transfer to purchase crypto (lower fees than a credit card) and make sure you enable two-factor authentication on any site you use.

If you want to learn more about crypto basics, check out this collection of resources.

Don’t diversify for the sake of it.

This is going to be pretty unpopular advice. All over the internet, you’ll find people telling you to not put all of your eggs in one basket. This is true for pretty much every type of investment. It’s certainly true in sports speculation; DFS players are told to diversify their player exposure and sports bettors to hedge their bets.

I don’t believe this is smart. The only reason you should diversify is to be able to invest more money, overcoming a lower ROI with more volume to see greater long-term gains.

I’ll use DFS as an example since that’s my expertise. If you think Michael Thomas is the top wide receiver play this week, you should have as much money on Thomas as you’re willing to stomach. It’s high-variance to not diversify, which is why people avoid it—it feels shitty to have large swings—but it will lead to the greatest ROI over the long run (if you’re right).

So why not put Thomas in every lineup? Well, you’re always trying to balance the highest possible ROI—which zero diversification allows for—with the greatest overall profit and the lowest possible risk of ruin (going busto). If you were to seek the highest ROI and greatest profit, you’d not diversify at all and play 100% of your bankroll, which would of course be idiotic since your long-term risk of ruin would be 100%.

As it relates to crypto, I’m of the opinion that you should identify what you believe is the best value, then invest as much money as you’re willing to lose in that single asset. Then, knowing that adding another coin—diversifying—can slightly reduce your risk of ruin, put as much money as you can stomach into that (which should be a lower amount).

In this way, you’re diversifying solely to be able to invest more money, increasing your profit and reducing your risk of ruin.

Okay, now two caveats. The first is that the swings in crypto are bananas. If you haven’t woken up to 35% of your investment just—poof—gone, you haven’t lived my friend. And so with that greater volatility comes more of a reason to hedge.

The second caveat is that it’s more difficult to know what’s “optimal” in cryptocurrency than in other alternative investments. Although I might be off a bit here and there, I pretty much know the top values—or a small pool of players who could be considered the top values—in DFS. It’s somewhat obvious. That’s probably not true in crypto—certainly not to the same extent and especially not for someone like me who doesn’t know what the hell he’s doing.

If you believe in the overarching concept and believe the entire cryptocurrency market cap will rise, there’s an incentive to just stay in the game, meaning it’s probably wise to diversify more here than in more “solved” games like DFS.

Nonetheless, I think something like a 60/25/10/5 type of split is better than putting 5% of your cash into 20 different coins.

Market cap matters more than coin price.

A friend of mine saw that I had some early trading success—mostly just the result of a bull market for altcoins and a few lucky moves—and asked if he could give me some money to invest. I agreed, and so he’s become interested in the space and has his own suggestions of trades to make. In the beginning, those were often, “We should get XYZ because it’s under $1.”

This is the most common mistake I see made by those new to crypto. The price of coins is relevant only after accounting for the circulating supply. The number of coins multiplied by the price of those coins is the total market cap for the token, and that’s what really matters. When you buy any coin, what you should really be focused on isn’t the price of the coin, but what percentage of that total market cap you’re purchasing.

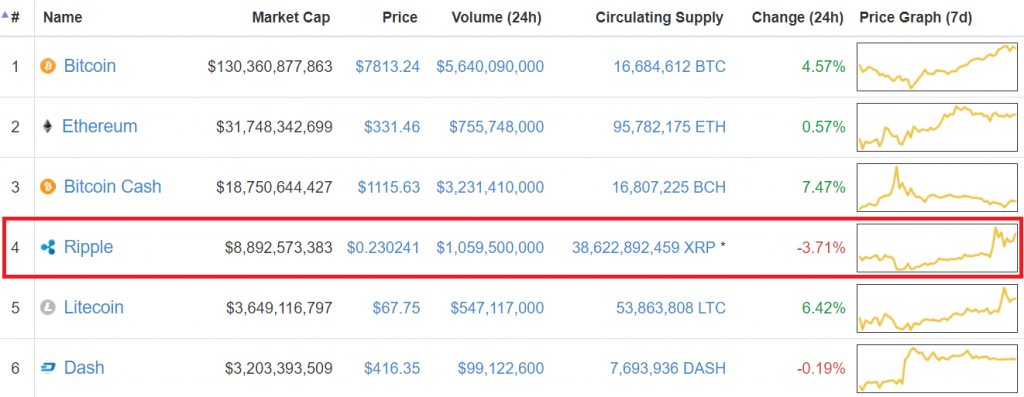

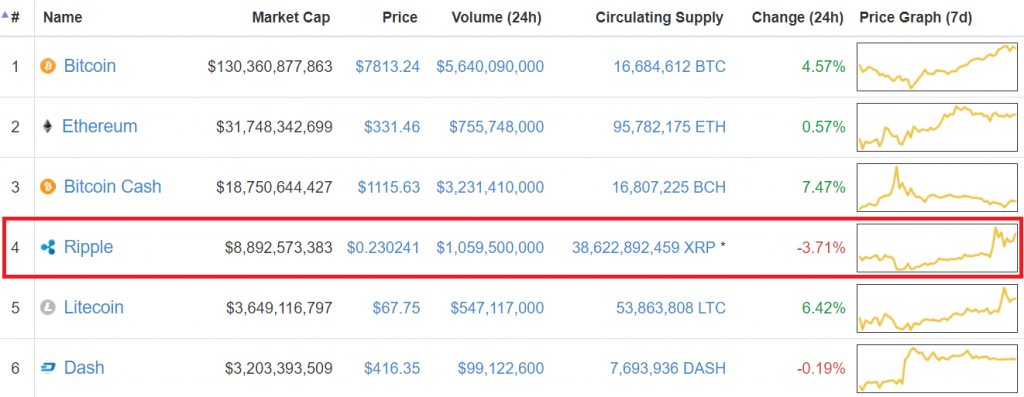

As an example of the difference, take a look at the top six coins in terms of market cap (specifically Ripple), via CoinMarketCap.com:

At the time of writing this, Ripple costs 23 cents—nearly 300 times less than Litecoin and 1,800 times less than Dash. Nonetheless, because of the way in which Ripple operates, there’s a much larger circulating supply, and thus the market cap of Ripple is over twice as large as Litecoin and Dash.

On the flip side, I can’t tell you how many people I know have said, “I’m not buying Bitcoin right now. If I invest $5,000, I can’t even get a whole token.”

But who cares? If the market cap of Bitcoin increases by 20%, someone investing $5,000 will have made $1,000 in the same way that they’d make $1,000 if Ripple increases 20%. Yes, it could be easier for certain coins to see massive swings in value, but that would be due to their market cap and not the coin price. It’s more difficult for Ripple (nearly $9b market cap) to go from 23 cents to 46 cents than for a coin with a $100 million market cap to double in price (regardless of the cost of one token).

The point is that the price is effectively arbitrary based on the circulating supply of tokens. If there were theoretically just one circulating Bitcoin that cost $130b+, it wouldn’t change the merits of your $5,000 investment in it.

Don’t get hung up on the absolute price.

Don’t take profits unless there’s a change in circumstances.

I got a hotel in NYC a couple weeks ago and planned to go up for the day. When that day came, I just didn’t feel like going anymore, so I didn’t. The fact I paid for the hotel meant nothing—it was a sunk cost and that money was gone—and so the only relevant factor was really whether or not I felt like going to NYC that day.

Don’t let past decisions affect future ones if they have no bearing on your happiness (or, in investing, your expected value). With any investment, it’s irrelevant whether or not you’re up or down or you’ve removed your initial investment or you’ve run it up 10x or whatever. I can’t tell you how many times I’ve been talking with my mom about crypto and she has said, “You should take out some of the money you’ve made.”

There are really only a couple reasons you should be taking profits, all of which are the result of something changing. One would be that your net worth has shifted and you’re over-exposed to crypto. As an example, let’s say you bought Bitcoin at $1k with $50k in the bank, and you think it’s smart to have 20% of your money in BTC (so you bought $10k of it). If the price of BTC is now $8k and you didn’t sell, your BTC would be worth $80k. Assuming your net worth otherwise didn’t grow, you’d have $80k in BTC and $40k in cash. Even if holding is +EV, it might be too much risk for you to stomach, in which case you’d be justified in taking money out.

Of course, if you think the future of crypto has changed for the worse—or that your money could be better invested elsewhere—then you’d also be justified in changing your allocation.

Finally, although it’s admittedly irrational, I think you could make an argument for removing your initial investment solely for peace of mind. If you invested $1k in crypto and have run it up to $10k, removing the initial $1k isn’t the worst idea if you think it will help you psychologically. A lot of people think and act differently when they’re on a freeroll; just look at how people act in casinos when they’re “playing with house money.” If it is comforting to you think “the worst that can happen is I’m back to even,” then removing a small portion of your crypto funds so you’re on a freeroll is probably fine. It’s not mathematically the right decision, but you can potentially make up for the loss in EV from just having peace of mind that you’ll never be down from your investment.

The goal isn’t to be right as often as possible.

The goal is to make as much money as possible. I’d rather be right 10% of the time but see 100x returns when I hit than to be correct 80% of the time and see 2x returns. Being right is comforting, but finding disproportionate payoffs on events others are overlooking makes you more money. This is related to antifragility—a concept I talked about in my post on why I bet on Trump to win the presidency.

Crypto worth should be measured against both USD and BTC.

Let’s say the current prices (in USD) of Ethereum and Bitcoin are $350 and $7,000, respectively (meaning one BTC is 20x more valuable than one ETH in terms of dollars). If the price of BTC rises to $7,350 and ETH stays the same at $350, the latter coin will show just under a 5% decline in value when compared to BTC. In terms of your purchasing power if you were to convert your ETH to USD, nothing really changed, even though the ETH/BTC rate got worse.

So did ETH decline in value? Yes and no.

Although you still have the same amount of money (in USD), you should still care about how other cryptocurrencies compare to BTC because, long-term, you should be making trades that increase your overall BTC value. That doesn’t mean you need to hold exclusively BTC, but your goal should always be to improve the overall value of your crypto portfolio in terms of BTC. If you’re not increasing that number—even if the dollar value of your holdings is increasing—it means you’d be better off just buying and holding BTC (which might be the right move for many).

Buy Low and Sell High?

Well, yes, duh, you should always be looking to buy low and sell high. However, I’m of the opinion that it’s much, much tougher to recognize peaks and valleys in cryptocurrency since the market is so much different—and likely irrational—than something like the stock market. Given that so much of the value is speculative, short-term price fluctuations—especially for many altcoins—are more so a reflection of hype than underlying value.

As an example, let me tell you a little story about a coin called SAFEX. I bought a decent amount of it in early August. Why? I don’t even fucking remember. It was probably awful reasoning.

A few days later, I went golfing with some friends. I shot 54 on a nine-hole Par 3 course, by the way, even though I used three balls and wrote down the best score on each hole. I’m no Kim Jong.

We started golfing at like 10am and by the time we finished at around noon, SAFEX had skyrocketed like 4x or something crazy. Why? No idea. Had I checked in halfway through that rise, I probably would have “sold high” and missed out on a lot of money.

This has happened in the opposite direction, too; when China banned ICOs, I bought a bunch of BTC after it had dropped quite a bit…only to see it decrease like 20% more.

Anyway, my point is that trying to time trades over small windows of time is very challenging. I’m all for buying and selling based on hype, but don’t get cocky in thinking you can identify highs and lows.

Buy now.

Related to this idea is your strategy for timing your buys. I’ve seen a lot of advice that looks something like this…

Again, I think recognizing the bottom of dips when they’re happening is much more difficult than people think. Either way, the only reason you should ever be waiting to invest in any coin that you think will appreciate long-term is if you think there will be a short-term dip. Otherwise, if you think it’s a good investment, you should be buying as much as you can possibly stomach right now. If your portfolio changes and you want to purchase more in the future, you should again buy as much as you can take on then, too. It doesn’t make sense to invest at regular intervals unless that’s all you can afford to put in each time.

If you look at the graph above, yes, you’d be slightly better off buying at those dips than the peaks that came before them. But you’d be much better off if you just put all the money in from the start. Hell, you could completely miscalculate the timing and invest all of it at the first peak and still come away much better off than saving money to buy dips.

If you’re bullish on a crypto, the only reason to wait on investing everything you can is if you think there’s a short-term drop in store.

Buy early, sell early.

The best approach with BTC, if you believe in its long-term outlook, is to buy, hold, and don’t worry about short-term fluctuations in value. If you you’re actively trading coins you don’t plan to hold “forever,” however, you obviously need to have some sort of strategy with when you plan to buy and sell.

“Buy the rumor, sell the news” is a popular phrase in trading. One example of how I fucked that up is with Legends—that token I referred to that you can use in certain Vegas strip clubs. I had seen some data on the value of LGD increasing prior to big boxing matches in Vegas, so I bought a bunch a couple weeks prior to the last Mayweather fight.

Was that smart? I have no idea what the “true” value of LGD might be, but I did know there was some buzz beginning to pick up on Reddit about how it would increase as the fight approached. In that instance, I didn’t really care too much about what LGD was “worth” in some absolute sense—just what other people would think about it short-term. I bought it at around $1.50 and it was above $4.00 at one point.

An important part of this, of course, would be figuring out when to unload it, unless you find it prudent to be a long-term holder of a strip club currency. And hey, I don’t know your life habits, maybe it is.

For whatever reason, I decided to sell a little bit of LGD the morning of the fight—which was smart—and hold onto the rest. I don’t know what I thought was going to happen—that it would soar that night?—but it started to tank that afternoon and night as those speculating on it began to unload. I was at the DraftKings MLB Championship and not really paying close attention, which—and this is unfathomable—ended up being a #badidea. Turns out when you’re hoarding strip club tokens you think are going to plummet in value in a matter of hours, you do want to be paying attention to what the fuck is going on.

Anyway, in most cases with coins like LGD, it’s better to unload too early than too late if you think their current value is highly inflated due to hype. Even if you believe there’s a chance for more gains, at a certain point, the upside is certainly not worth the risk.

You can be greedy, but don’t get too greedy.

A few other random tips I am going to list but don’t have time to talk about at length…

- If you’re unsure if you should make a trade, don’t.

You should have a good enough reason to buy, sell, or trade that you’re confident you need to do it.

- There’s no single portfolio allocation right for everyone.

This is dictated by your bankroll, risk tolerance, and available time, among other things.

- Know how coin types and correlations affect your volatility.

Certain coins tend to move in unison, while others are negatively correlated.

- Keep your emotions in check.

This is incredibly important. You’ll almost always feel overconfident after a good trade and like a moron after a bad one. That’s natural. Don’t let it affect your decisions. Most of what’s perceived as skill (or a lack thereof) is just randomness.

Okay, I’m gonna go eat now. My next post will be a follow-up to my article 40 Counterintuitive Tips for Building a Business.